Media releases

Westpac introduces new scam detection technology

2 July 2025

Westpac has today announced the introduction of Confirmation of Payee, a new security feature designed to help customers spot a scam and reduce mistaken payments.

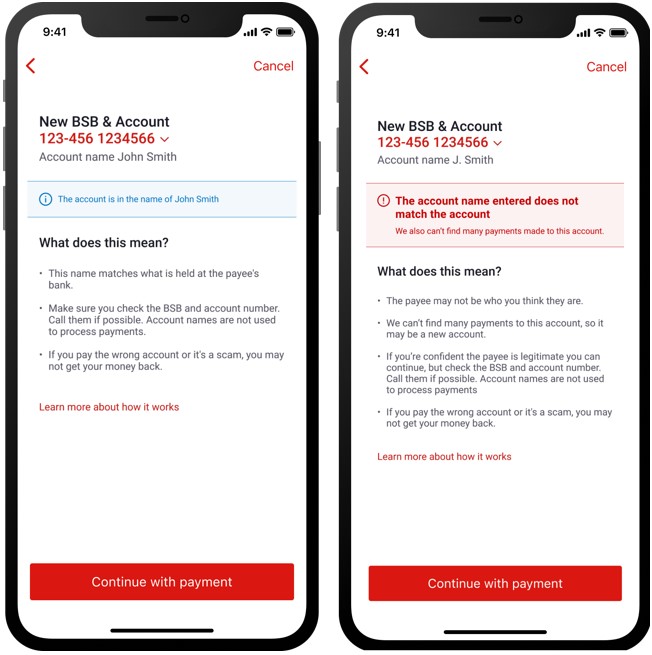

The new technology builds on Westpac’s existing Verify capability, which already alerts customers when an account name doesn't match the BSB and account number used in previous payments by other Westpac Group customers. Confirmation of Payee adds another layer of security by checking the account name against the records held at the recipient’s bank, giving customers greater confidence before they make a payment to someone new.

Westpac Head of Fraud Prevention, Ben Young said the new technology is part of the bank’s ongoing investment in scam protection.

“Scammers are becoming more sophisticated, finding new ways to trick unsuspecting Australians into handing over their hard-earned money. This is why it’s so important for us to continue to invest in ways to help keep our customers safe,” Mr Young said.

“The introduction of Confirmation of Payee builds on our existing Verify technology and will help customers confirm they’re paying the right person, potentially stopping a scam in its tracks.”

Since launching in June 2024, Westpac’s existing Verify technology has prevented more than 400 mistaken payments each day and stopped customers from losing over $6 million to scammers.

“We’re continuing to take the fight to scammers to help keep people safe, but we can’t do it alone. We need other organisations, like telcos, digital platforms and social media companies, to adopt similar protections so we can collectively raise the bar on customer security,” Mr Young said.

Verify with Confirmation of Payee is the latest in Westpac’s suite of scam prevention initiatives, including SafeCall and SaferPay. Together these initiatives have helped to prevent customers from losing over $500 million to scammers over the past two years.

ENDS

Protection measures available for Westpac customers:

- Westpac SafeBlock – coming soon, SafeBlock will allow customers to immediately block their account in the app or online banking, when they suspect they are being scammed.

- Westpac SafeCall – provides customers with calls via the app that are Westpac branded, verified by Optus and show a reason for the call.

- Westpac SaferPay – presents customers with a series of questions in instances where a payment is considered a high risk of being a scam.

- Westpac Verify with Confirmation of Payee – alerts customers when there is a potential account name mismatch when they’re adding a new payee using a BSB and account number. Verify is also available for St.George, Bank of Melbourne, and BankSA customers.

- Dynamic CVC – changes the three-digit code on the back of the digital card every 24-hours. This feature is also available for St.George, Bank of Melbourne, and BankSA customers.

- Cryptocurrency blocks – for payments to certain digital currency exchanges.

- Merchant blocks – for payments to businesses deemed high-risk of being a scam (e.g. offering fake or misleading products and services).

- Call spoofing measures – added 94,000 Westpac numbers to the ‘Do Not Originate’ list preventing scammers from impersonating the bank’s phone numbers.

- Inbound payment detection – monitoring on some payments coming into the bank to check for potential scam indicators, with funds held where a scam is detected.

- Sophisticated detection technology – advanced behavioural tool helping combat remote access scams.

Media Contact: